When I am asked how to improve yields or reduce cost with a printed circuit board design, my mind immediately races ahead to the most common cost drivers: Has the part been designed with manufacturability in mind? Does the material selection make sense when balancing cost and performance? How many layers and lamination cycles are needed and could that number be reduced in any way? Has part size and panelization been considered? Are there any specific design features that push traditional design rules? All of these things have a direct impact on the manufacturers yield and the subsequent cost of the PCB.

One question that is rarely asked however is this: how does a PCB sourcing strategy impact yields? I know, yields are typically associated with the manufacturer’s process capabilities and process controls as related to the printed circuit board design. But, let me pose a few questions to help shed light on the impact that PCB sourcing can have on manufacturing yields and subsequent profitability.

Have you ever wondered why it is so difficult to find a fabricator that can meet ALL of your needs? Wouldn’t it be great to find the perfect manufacturer, the one that has amazing service, does exactly what they say they are going to do AND has competitive pricing (total value, not just board price) across all the various technology levels?

The fact is, it is extremely rare for an OEM to have a homogeneous technology level across their entire PCB demand. On any given project, there may be a few 2-4 layer designs, a few 12 layer designs, a difficult motherboard design and maybe even a flex or rigid flex design.

It is also a fact that PCB fabricators have a “sweet spot” that best fits their equipment set, engineering expertise, facility size and company culture. Very often, browsing through a website or brochure will leave the impression that a manufacturer provides a “full range of technology”: 2 layer to 30 layer, .010” drill to microvias, standard materials to specialty materials, quick-turn prototype through volume production. At the end of the day, no fabricator wants to turn away business and they try to do their best to supply what their customers need.

BUT, there is always be a technology level, material set, or delivery window that each shop excels at. Their yields are maximized, the corporate culture embraces the technology and lead-time and ultimately prices are the most competitive. As an example, a supplier that excels at building 4-8 layer standard technology, likely runs with yields in the 97%+ range. But, if they were asked to build an 18 layer with blind and buried vias and via fill, the yields would drop dramatically. If the supplier that excels at building 18 layer blind and buried vias and via fill, with yields in the high 90% range was asked to build a rigid flex, yields would drop dramatically.

When sourcing PCB’s and creating a robust sourcing strategy, the challenge is identifying that “sweet spot” that maximizes a manufacturers yields and selecting the best group of suppliers to meet YOUR unique needs. Logically, if a circuit board is being sourced with the supplier that is the “best fit” for that specific technology level, their yields are going to be maximized, pricing will be its most competitive and ultimately profits will be increased for the OEM and the fabricator. While this sounds like a simple concept, the implementation of this strategy takes time and resources that are not always available.

Printed Circuit Board Sourcing Strategy, are you guilty?

Printed circuit boards are often one of the most expensive components of an assembly and arguably the most important due to their functionality and criticality. All too often, when time and resources are stretched too thin, these custom electronic components are purchased using the same strategy and structure as commodity items.

A PCB sourcing strategy might look like this:

- Treated as a commodity versus a custom component

- Procurement strategy is often made at a tactical, not a strategic level

- Many are doing business with suppliers without a full understanding of the technical capabilities, capacity or financial situations of their suppliers

- Static strategies in a dynamic market – this market is changing rapidly

- The same strategy is used for domestic and off shore sourcing. “One size fits all.”

This strategy can result in increased risk in terms of price stability and performance, increased risk of supply chain disruption and increased overall cost.

Do you need to revamp your PCB strategy? Where do you start?

You start with the basics. First review your PCB technology and volume requirements. Your requirements can then be segmented by attributes such as standard technology, HDI, heavy copper, flexible circuits, etc. Then search to match suppliers to these requirements. Audit the facilities. Don’t hesitate to ask the tough questions to REALLY understand the type of work each supplier excels at.

Next make sure that you have fully developed your procurement spec. Does it clearly spell out your requirements? Are any of your requirements adding unnecessary expense? It is not unusual to find that a corrective action implemented for an issue that happened 10 years ago is driving a requirement that increases cost and just isn’t necessary in today’s manufacturing environment.

Case study using strategic sourcing strategy:

Once a strong, diversified supplier matrix is put in place, analysis on large programs is simplified. To give an example, we were asked to assist with a pricing review and analysis of how to reduce cost on a specific project. This project included a set of PCB’s with a wide spread of technology. One design was a simple two layer design, another included microvias with copper via fill and there were three with technology between those two extremes. The volume required was expected to be between 1,000 and 5,000 pieces annually. We started first with the design for manufacturability questions and recommended adjustments where possible to increase yields at the manufacturer and ultimately reduce the total cost of the package.

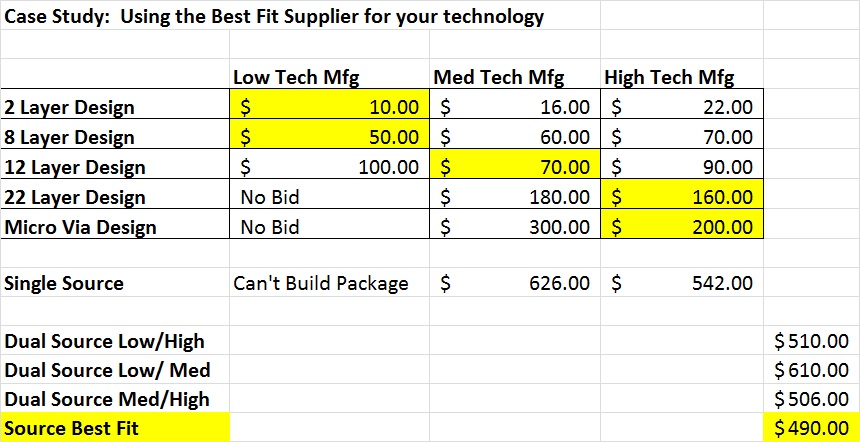

After this, we looked at the current supply base and sourcing strategy. The decided upon approach was to select three suppliers, each with different technology specialties, gather pricing for the package and review the total package to determine the best path forward. The results of that exercise are included below.

Case study: Strategic Sourcing Review, project volume 1,000 to 5,000 annually

As you can see, the lowest price option for each part number is highlighted in yellow. From there, we reviewed the package from a single-source, dual-source or three-source perspective. The single-source option was ultimately the more expensive approach, with a three -source strategy providing the lowest cost option when looking at the PCB’s only.

With a savings of $16 per set over the two-source approach, the company can be expected to save between $16,000 and $80,000 per year on this project. From here, they can determine if the additional costs associated with managing three suppliers on this project is justified by the savings.

Conclusion:

When analyzing a set of PCB’s to improve yields and maximize profits, the first place to start is with a critical review of each PCB design. Are there any attributes that are pushing your manufacturers standard design rules? If so, is this necessary to the design or is there another approach that could improve the manufacture’s yields, reduce cost, and ultimately increase profit? Once the design is finalized, a critical review of the PCB sourcing strategy should be completed. Does the technology of each design fit the sweet spot of the selected fabricator? Would a multi-source strategy result in cost savings that justify the expense of managing more than one supplier on the project? Just as time and effort are spent reviewing and analyzing the design, time and effort should be spent reviewing and analyzing the subsequent sourcing strategy. Matching the technology to the best fit supplier will optimize manufacturing yields and reduce overall cost.

Contact us with questions or for additional information! www.omnipcb.com